The planet’s ecosystems underpin our economic system, with estimates of over half of the world’s GDP being moderately or highly dependent on nature and its services, and they are critical to our efforts to deliver on the target of limiting global warming to 1.5°C. However, despite their clear importance, they are being destroyed at a rapidly accelerating rate: almost 50% of the world’s habitable land has now been lost, with half of this destruction taking place in the last 100 years. Given the financial sector’s integral role in underpinning the global economic system, financial institutions are highly exposed to the risks of ecosystem loss through their financing of and investments in companies. These risks can be summarized into three types:

There are five key steps for financial institutions to address these risks to their portfolios, which are summarized as follows:

Step 1

Understand material risks

Before being able to take action effectively, a financial institution must develop a clear understanding of its risk profile. This involves first understanding which regions and sectors carry the highest risk, and then mapping current clients and investees against this set of regions and sectors to identify which have probable exposure to deforestation and conversion risks.

Given that financial institutions typically invest in and/or finance a large number of companies, for effective due diligence, monitoring and engagement, it is essential to then sort this list of clients and investees with probable risk into different levels of priority. This prioritization should consider two factors:

Degree of exposure, reflecting the scale of financing or investment and extent of connection between the client or investee and high-risk regions / sectors.

Strength of mitigation response/client risk controls, reflecting the presence of a commitment/policy targeting deforestation and ecosystem conversion risks, and evidence that the client or investee is taking acting towards mitigating them.

↑

Step 2

Develop an effective deforestation and conversion free policy

Once a financial institution understands its risk exposure, the next step is to develop a policy that effectively targets these risks, satisfying three conditions:

Step 3

Conduct due diligence and monitor progress

Incorporate deforestation, conversion and associated human rights factors into ongoing risk management and other decision-making processes, assessing both existing and potential clients on their deforestation and conversion risk profile and mitigation efforts.

Specific factors to consider include the presence and strength of policies at the client/investee level to mitigate deforestation, conversion and associated human rights risks; demonstration of supply chain traceability; and instances of deforestation, conversion or associated human rights violations occurring in a client or investee’s operations.

↑

Step 4

Engage clients and investees

Active, early engagement is essential to support clients and investees in their journey to align their activities with the terms of the financial institution’s deforestation and conversion free policy. It also sends a clear signal of intent that the financial institution is serious about implementing its policy, driving more voluntary adherence. An effective engagement strategy consists of two components:

Step 5

Report transparently

Frequent, transparent reporting both ensures recognition for the progress being made and generates pressure on other financial institutions to eliminate deforestation and conversion from their portfolios, reducing risks across the finance sector more broadly. Financial institutions should proactively report information on:

Evidence of implementation of initiatives to reduce exposure. This should include insights into risk assessment processes, engagement efforts and specific instances of divestment.

Financial exposure to deforestation and conversion risks. Insights should be provided on how this exposure is changing over time and how it relates to the targets outlined in the financial institution’s deforestation and conversion free policy. In 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) will release a framework for organizations to report on and manage exposure to nature risks and opportunities. Financial institutions should track and support the progress of the TNFD to ensure they are well positioned to action this guidance once released.

↑

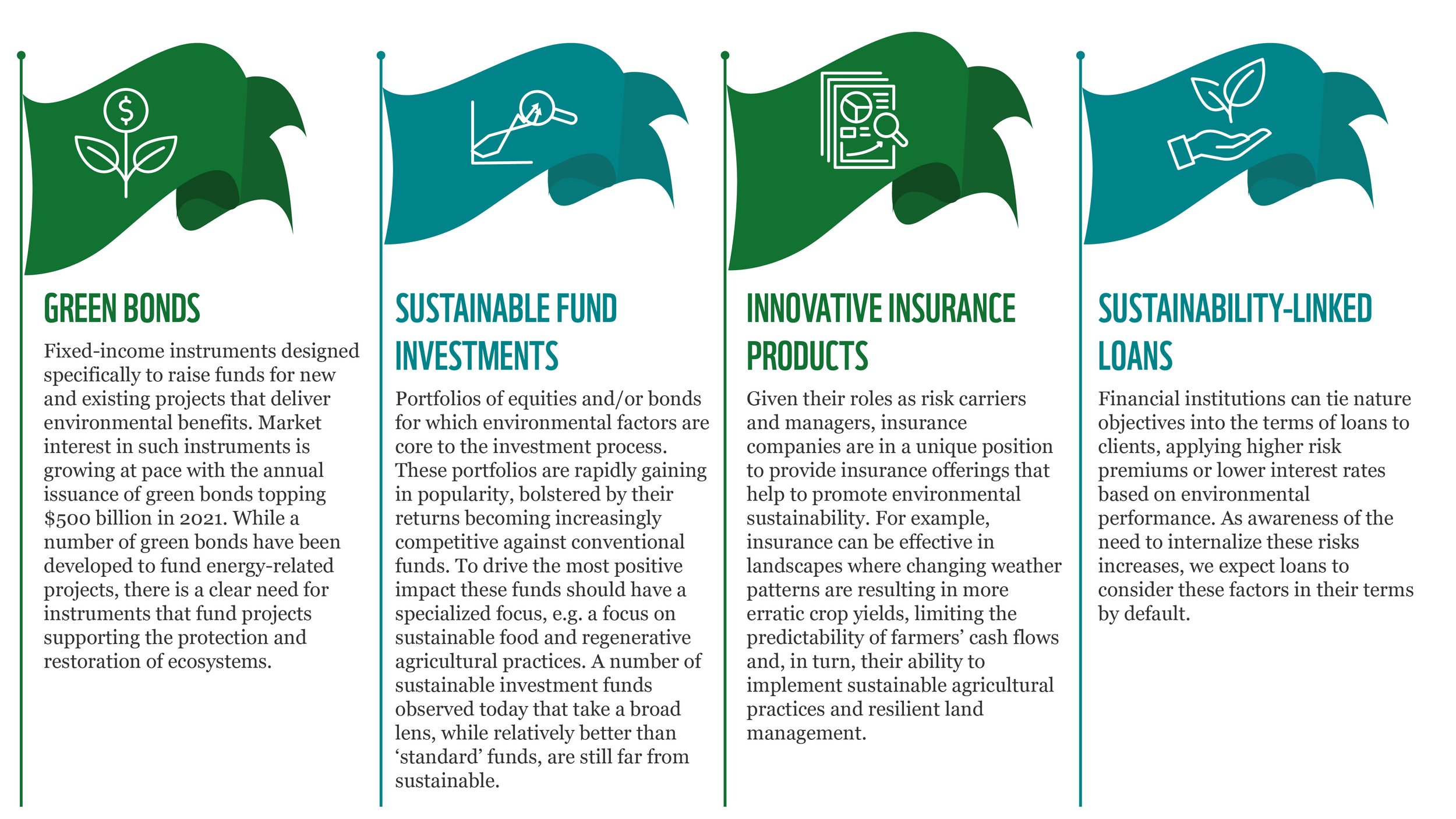

Nature positive finance opportunities

Beyond simply eliminating risks, financial institutions are also well placed to direct capital towards nature-positive activities that protect and restore these key landscapes. Furthermore, the rapid growth in interest in sustainable finance investments in recent years presents an attractive commercial opportunity to profit from these instruments while delivering a positive environmental impact. Specific examples include: